Bitcoin (sv) data annual review 2022 -- a year of building and growing

Bitcoin blockchain overview

| Metrics | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Transactions (million) | 54 | 239 | 198 | 952 |

| Size (GB) | 40 | 87 | 2204 | 6066 |

| Average tx size (bytes) | 737 | 364 | 11118 | 6370 |

| Average fee (satoshi) | 834 | 170.22 | 3816.7 | 407.8 |

| Average fee (usd) | 0.0009 | 0.0003 | 0.0061 | 0.0003 |

| Total fee (bsv) | 450 | 407 | 7568 | 3883 |

| Total fee (usd) | 49,545 | 80705 | 1,209,112 | 318,896 |

| Average tx ouput amount (bsv) | 6.8 | 0.8 | 7.9 | 1.2 |

Near one billion on-chain transactions have been processed in bsv network in 2022. It's 5 times than previous year. The average transaction fee is 407 satoshi, only cost $0.0003 at floating price. The network fee for processing the transaction charged by miners has dropped from 0.5 satoshi to 0.05 satoshi per byte, and even lowered to below 0.001 sometimes, thus the total mining fee jumped. Accumulated block size increased surprisingly by 6 Terabyte.

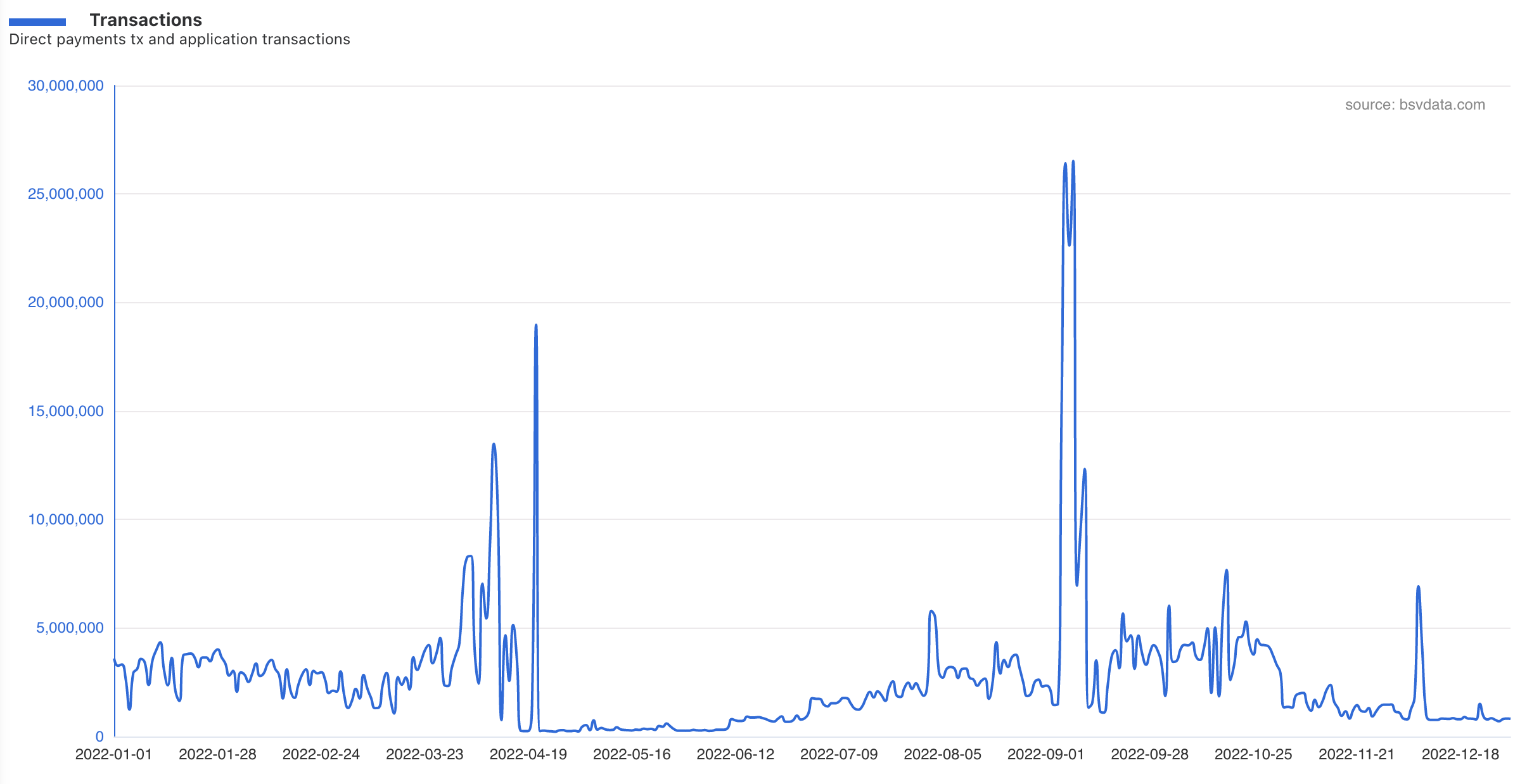

Daily transactions

952,315,970 transactions, nearly one billion, has been processed on the bitcoin sv blockchain in 2022, that's close to 2.6 million per day and 30 per second. There were some volume spikes, generated by applications, which hit over 26 million counts a day. The volume figure was supposed to go much higher if there wasn't a mApi limitation caused by a problem of legacy fee policy in the node software.

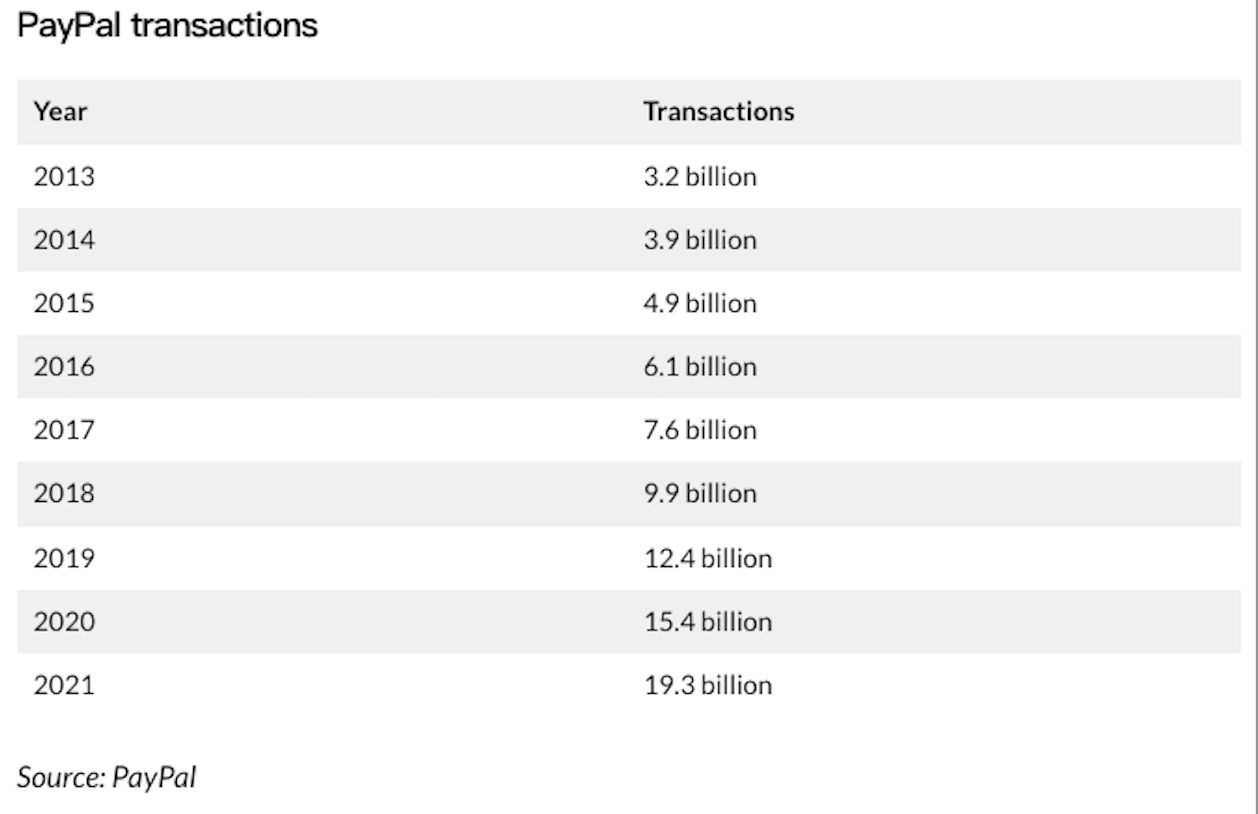

If we just simply compare the transactions number on Bsv blockchain with PayPal, the current scenario of bsv is like paypal prior to 2013. Though, undoubtedly, some volume spike on bsv are generated and paid for testing, but the potential to surpass the traditional payment protocols is very high when micropayments start to be adopted.

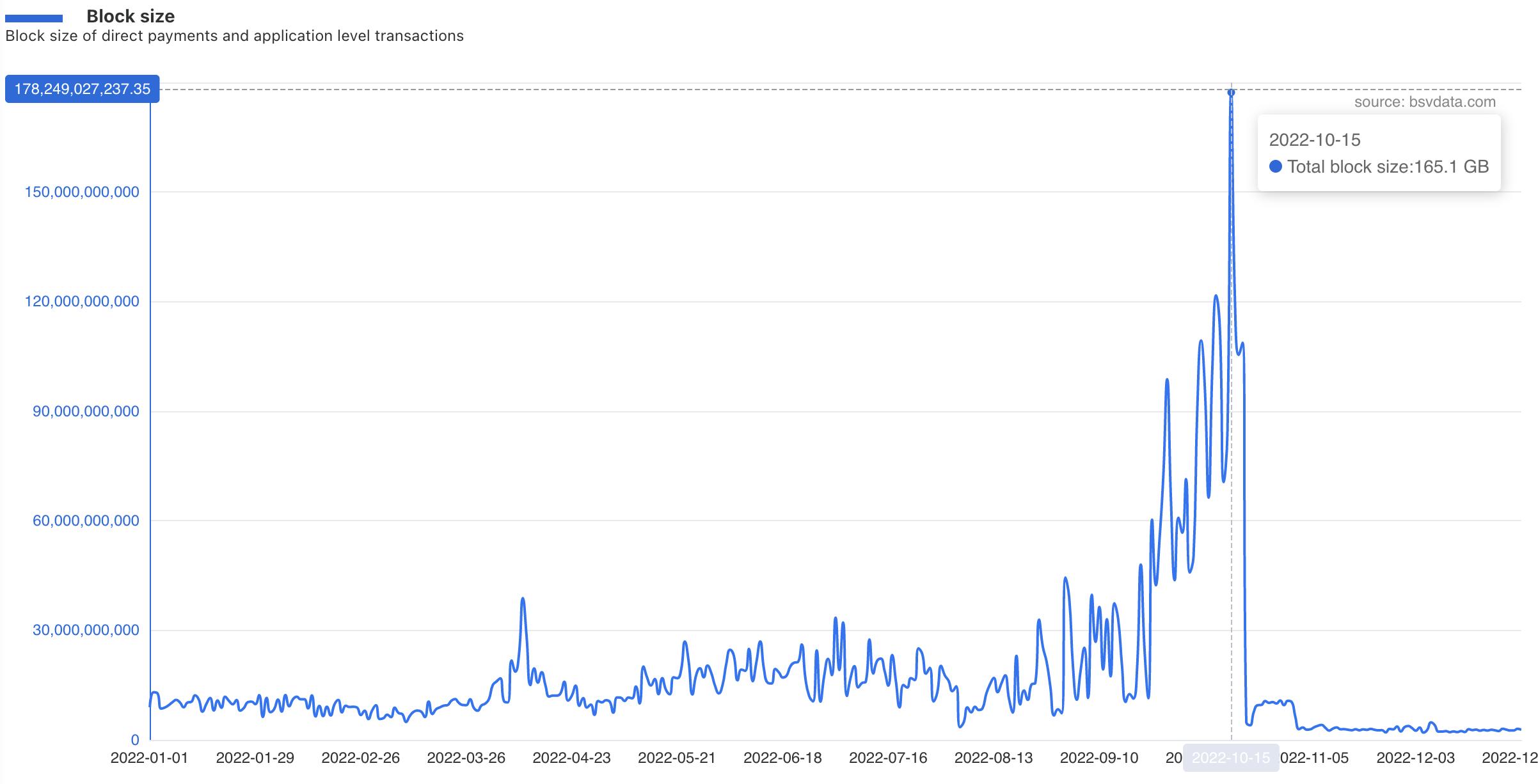

Block size

Around 6T of data have been put on-chain in 2022. Because of the incentive from extremely low fee policy provided by contractual miner, some apps, especially metaid protocol, pushed massive data on chain. The rapid growth rate of block size has been stopped due to fee policy change since late October. Hopefully it will follow a more natural growth path.

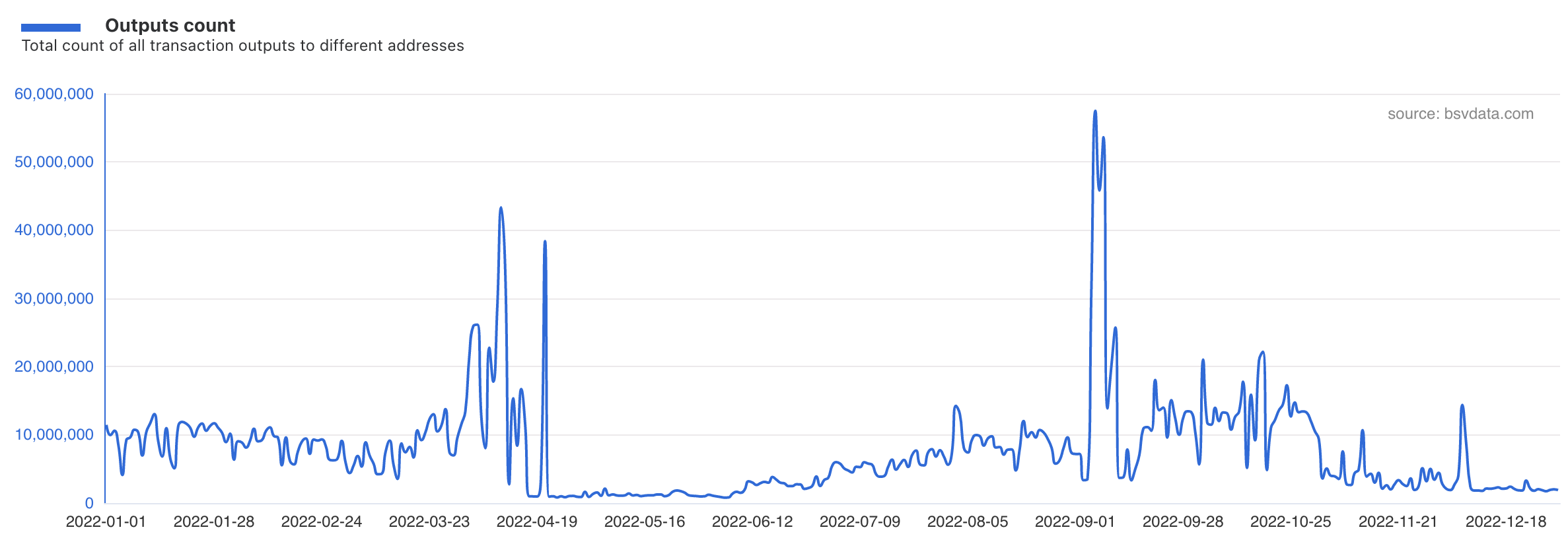

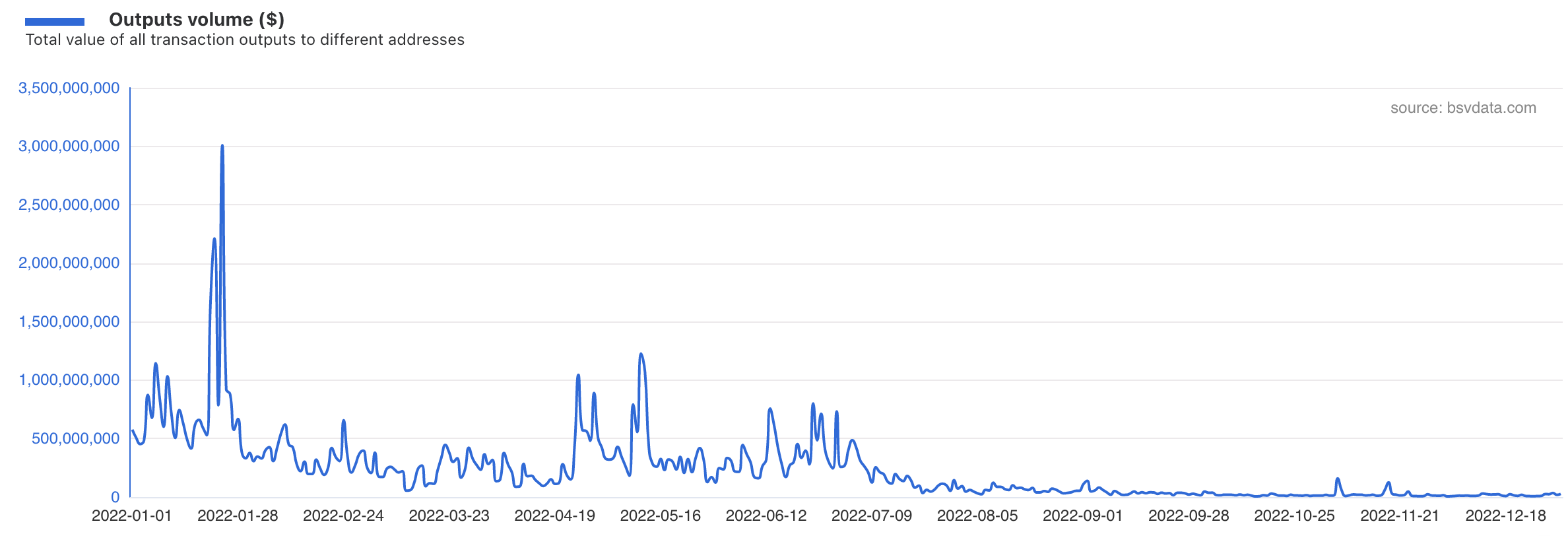

Transactions outputs volume

Number of outputs and monetary value in a transaction can roughly measure the economic activities in the blockchain. Generally, the more value put into the blockchain, the more economically significant. The number of outputs in a transaction can evaluate the complexity of an application, generally the more outputs the more layers or payees . The average transaction value is 1.18 bsv, and the average outputs number of transaction is around 3 in 2022.

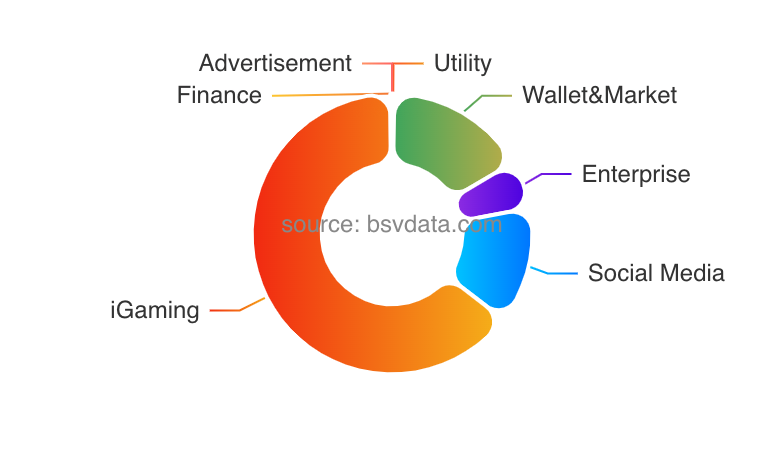

Applications

BitcoinSV blockchain has been used as a technology and protocol for micropayments. The low fee and scalability enable tokenization of any forms of items or contracts. There're around 50 applications that are actively putting on-chain data on daily basis in 2022. Gaming is still the most active section in the industry, followed by social media.

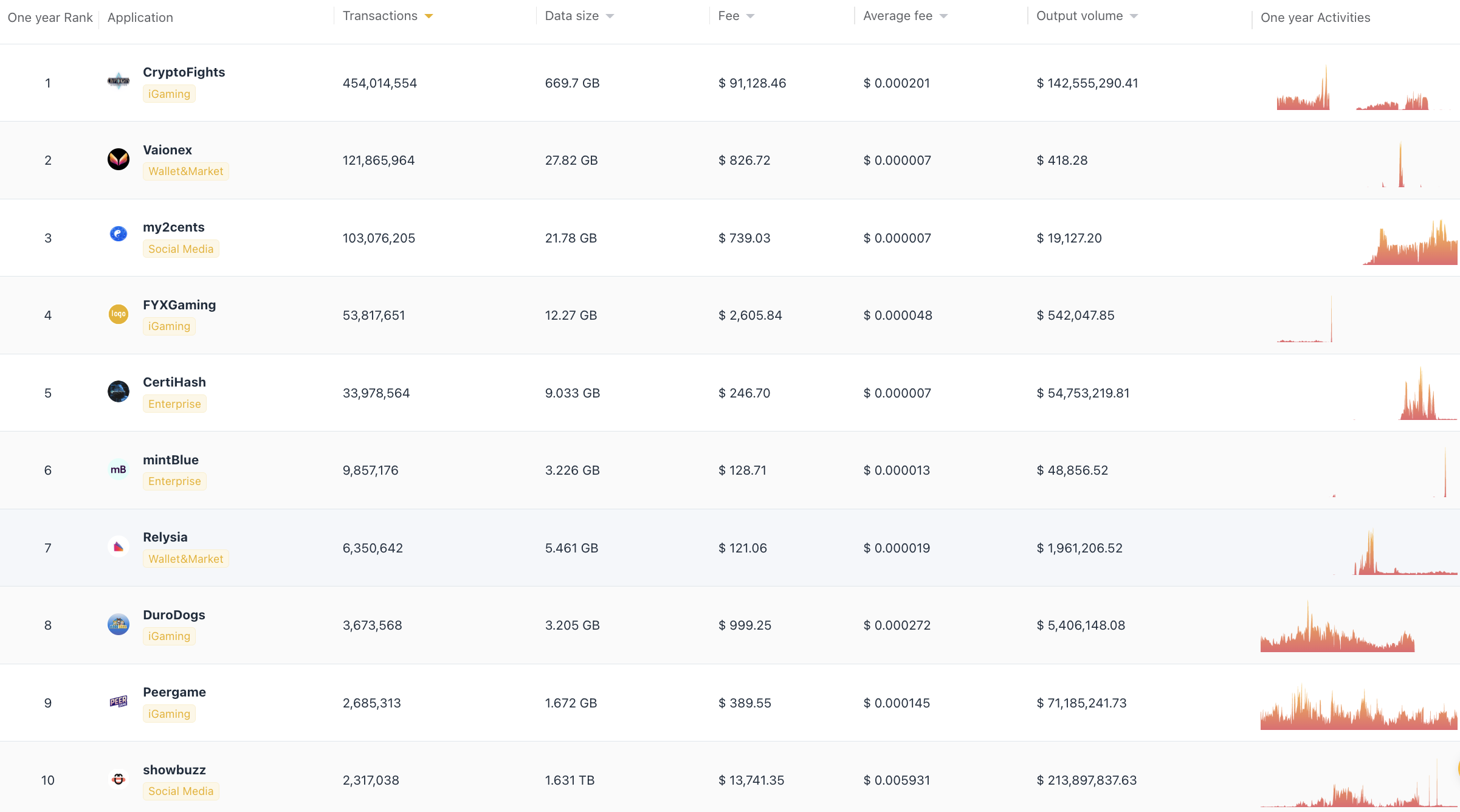

Top 10 applications ranking by transaction count:

CryptoFights(with FYXGaming protocol) generated the most transactions which is around 500 million with average fee $0.0002. In just one year, the size of data put on chain by CryptoFights has surpassed total node size of BTC or ETH. Through micropayments, CryptoFights tokenize interactions, items and exchanges in the game and also save essential user data into to ledger, that's why it can produce a very significant volume. Vaionex, a blockchain solution provider, generated a massive volume for scalability testing for several days. My2Cents, a social website , has been generating massive volume since August 2022. CertiHash and mintBlue , two prominent companies providing Enterprise products and solutions, started to put lots of data on chain in recent months. CryptoFights, ShowBuzz and Relayx are the top 3 who contributed the most mining fee.

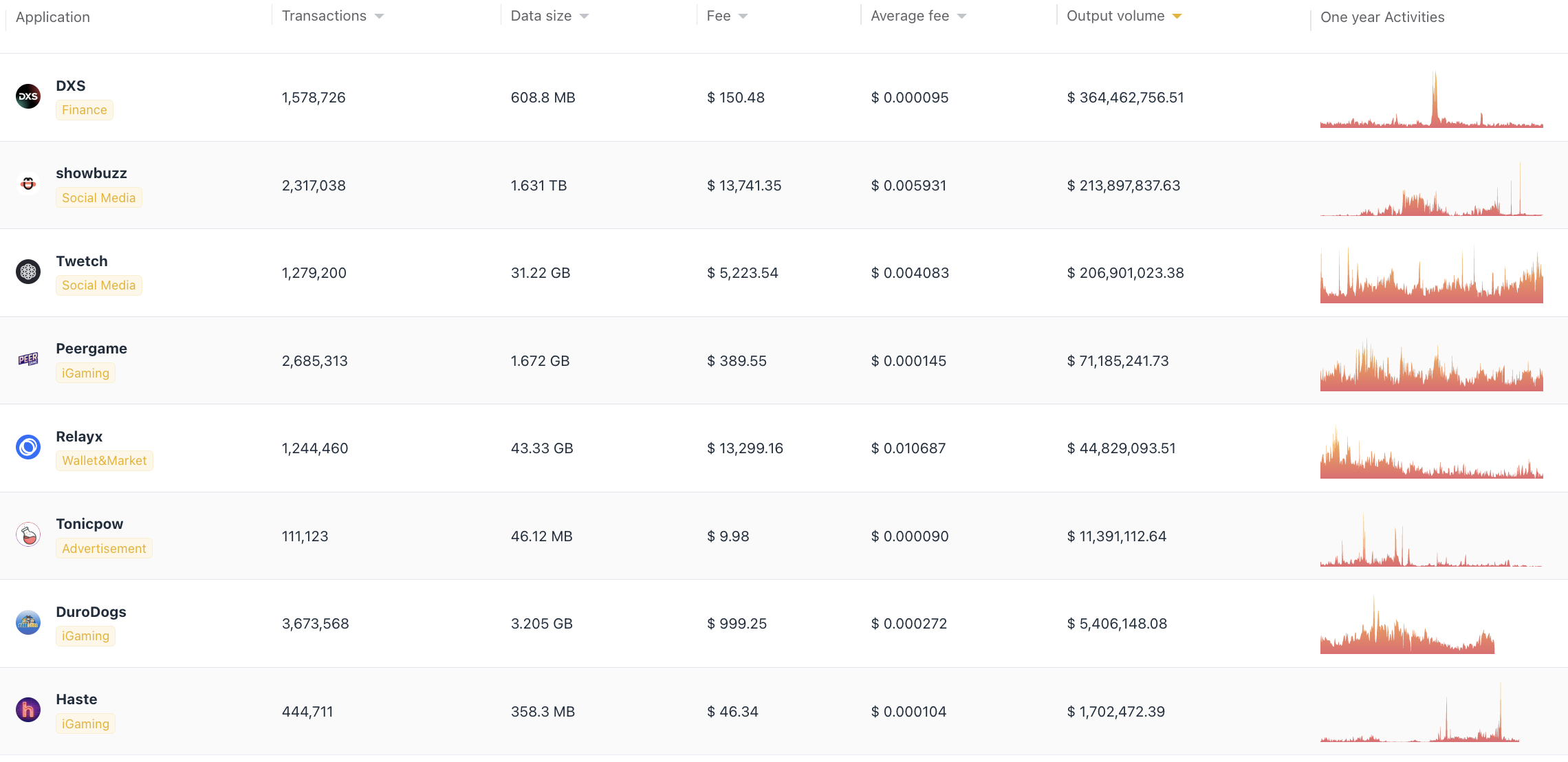

The most consistent applications through out the year of 2022:

Those applications above are operated throughout the year of 2022 without major interruption, and the transactions are mostly from users. They are gaming, social and financial apps. ShowBuzz, a Chinese twitter-like app, uploaded 1.6T data, the most among all applications. The volume of Twetch, the first ever web3 social network, is slightly greater compare to the previous year. Gaming apps Peergame, Haste, DuroDogs ... etc continue to use Bitcoin as micropayments protocol and store substantial among of user data on to the blockchain.

Tokens

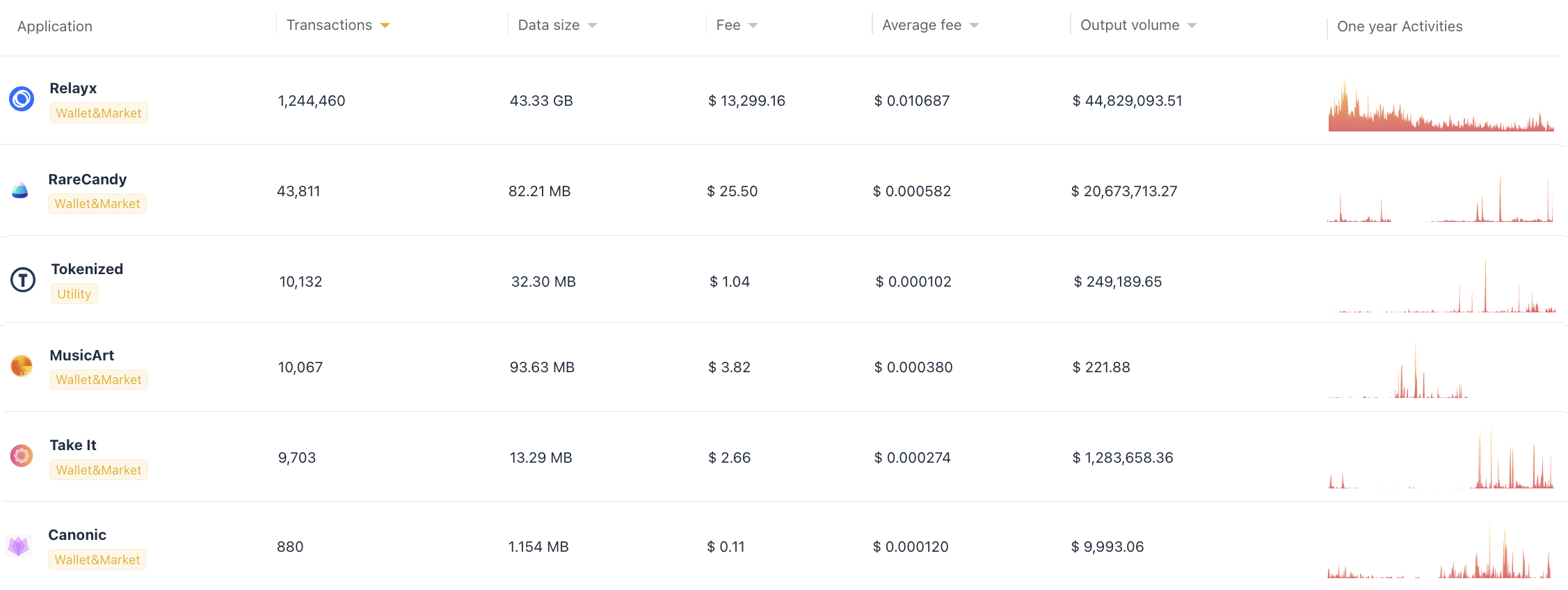

Metaverse and crypto related digital assets trading and speculation continued to dominate the blockchain market in the year 2022. In bsv space, there are also some platforms out there focusing on NFTs and tokens trading.

According to the statistics, Relayx is the most active player in NFT exchange and token swap. It produced over one million transactions and 43G data from issuing and trading tokens, uploading artwork images. RareCandy and TakeIt are new platforms that aim to follow the success of OpenSea. There're also some names not listed above, including BuzzMint and TokenSwap.

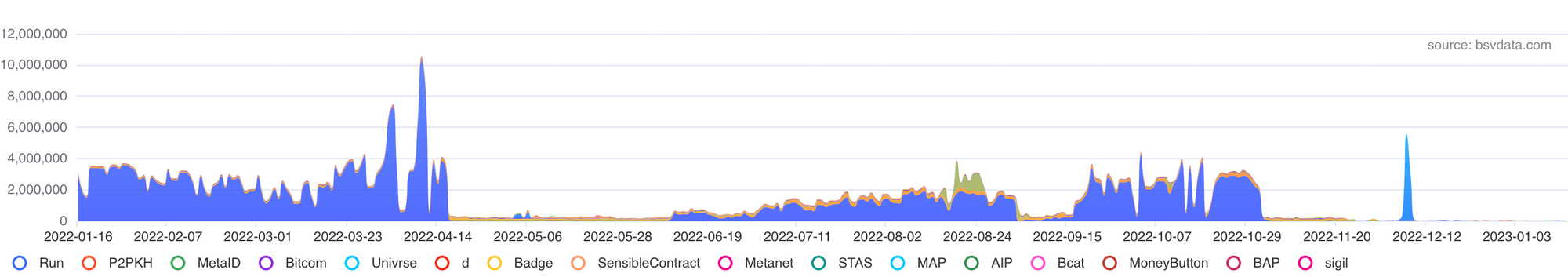

Protocols

There are multiple data or payment protocols on bsv network providing basic layers for all types of applications. A sub layer protocol plays an important role in Bitcoin ecosystem, whether it's a public standard for data opt/indexing/storage or a SDK tool/api for tokenization.

Near 500 million transactions processed through Run protocol in 2022, which used by CryptoFights, Relayx, Take It, CoinSurvey, etc. Sensible is the most used smart contract and token protocol on Bitcoinsv, followed by STAS . There're many types of content protocols action as different purpose to support app developers. Such as MAP protocol , though its volume is small , but it also used by many applications such as Twetch, TonicPow,BlockPost, Ark.page and Bitchat.

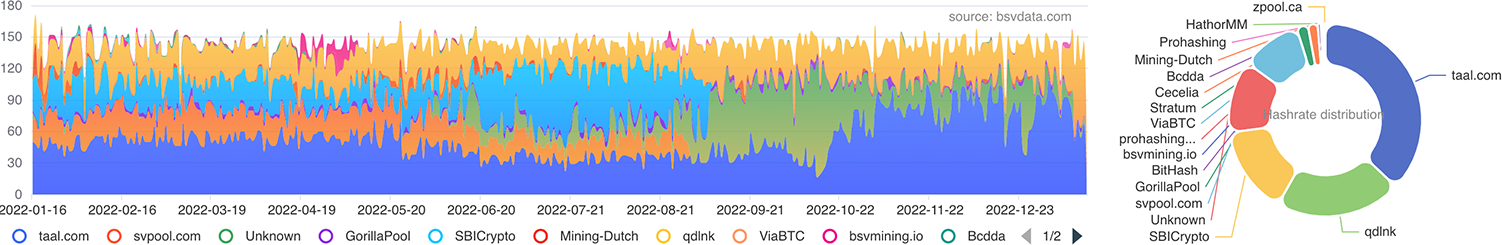

Mining

Here are some facts on mining bsv in 2022:

- Miners were rewarded 22 million USD by mining bsv in 2022.

- Mining fee has been reduce to 0.05 satoshi per byte in 2022 from 0.5

- Total fee earned by miners halved compare to previous year

- An unknown miner earned over 10 thousand bsv by mining empty blocks , which led to security issues such as transactions delay on the network.

- SBICrypto and svpool quit mining on September.

- TAAL and GorillaPool are the only two miners who involved in ecosystem development and support.